ASSET BASED LOANS

With an asset backed loan you can use your business

assets as collateral for immediate working capital

With an asset backed loan you can use your business assets as collateral for immediate working capital

Application Process

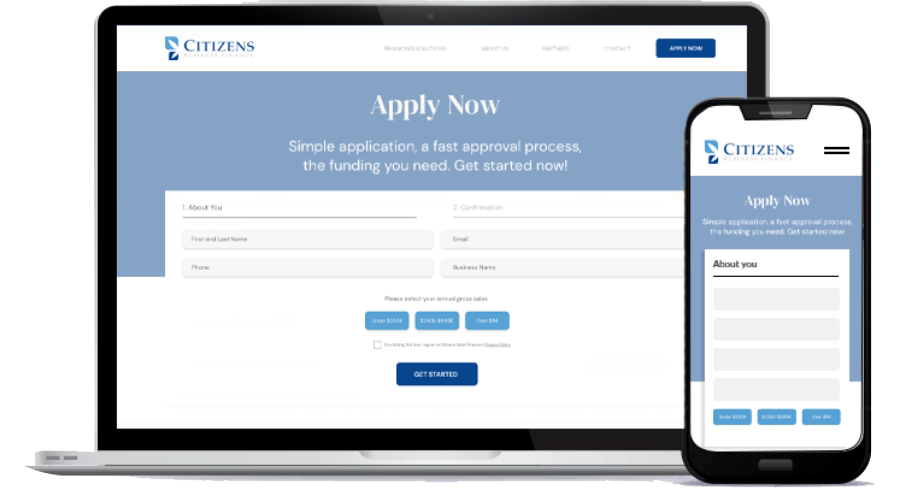

You can apply online or with a dedicated funding specialist. We recommend having the necessary documents on hand to make the process even faster (i.e. driver’s license or passport for the business owner, copies of business bank statements).

A dedicated funding specialist will carefully review your business financing application and reach out if we need any additional information. Once a funding decision has been made your dedicated funding specialist will reach out to you with funding options if approved.

If approved and you accept an offer funds will be sent to the business bank account provided. You could have your loan funds in as quick as 24 hours.

Find out how much you qualify for

"*" indicates required fields

By clicking the button above, you authorize Citizens Business Finance to contact you at the numbers you provide (including mobile) during any step of this application, via phone (including SMS and MMS means)

Asset Backed Loans FAQs

An asset backed loan is a loan that is secured loan using business assets. Most lenders use the loan-to-value ratio to determine the amount of money they’re willing to approve based on the value of the business assets.

In the event of a default on an asset backed loan, the lender may be able to take or sell the asset that was collateralized to pay off the remaining balance of the loan.

Since an asset backed loan uses the businesses assets as collateral, the loan is considered less risky by the lender. Since the risk is lower, generally asset backed loans are given lower rates and better terms.

The most common type of assets that are accepted for asset backed loans are: accounts receivables, equipment, Inventory, vehicles & real estate. However, there are additional types of collateral that lenders may accept on a case by case basis.

Since the lender is collateralized with an asset of the business, the risk is lower for the lender and they can often work with a lower credit than a non-collateralized loan. In the event of a default on an asset backed loan, the lender may be able to take or sell the asset that was collateralized to pay off the remaining balance of the loan